Enterprise Risk Management Software

Insightful risk management software, embedded across your organisation

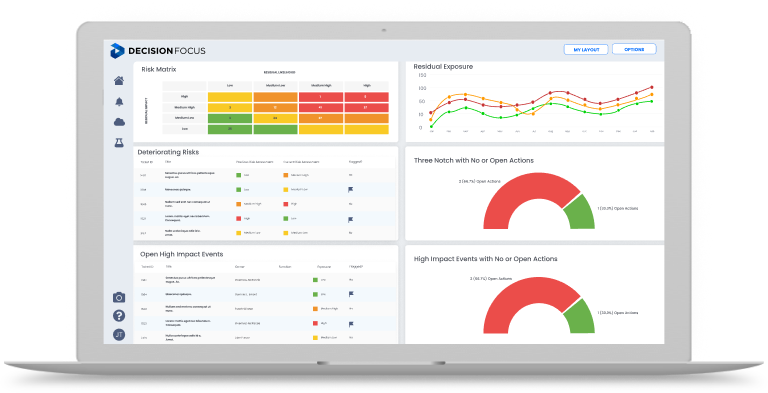

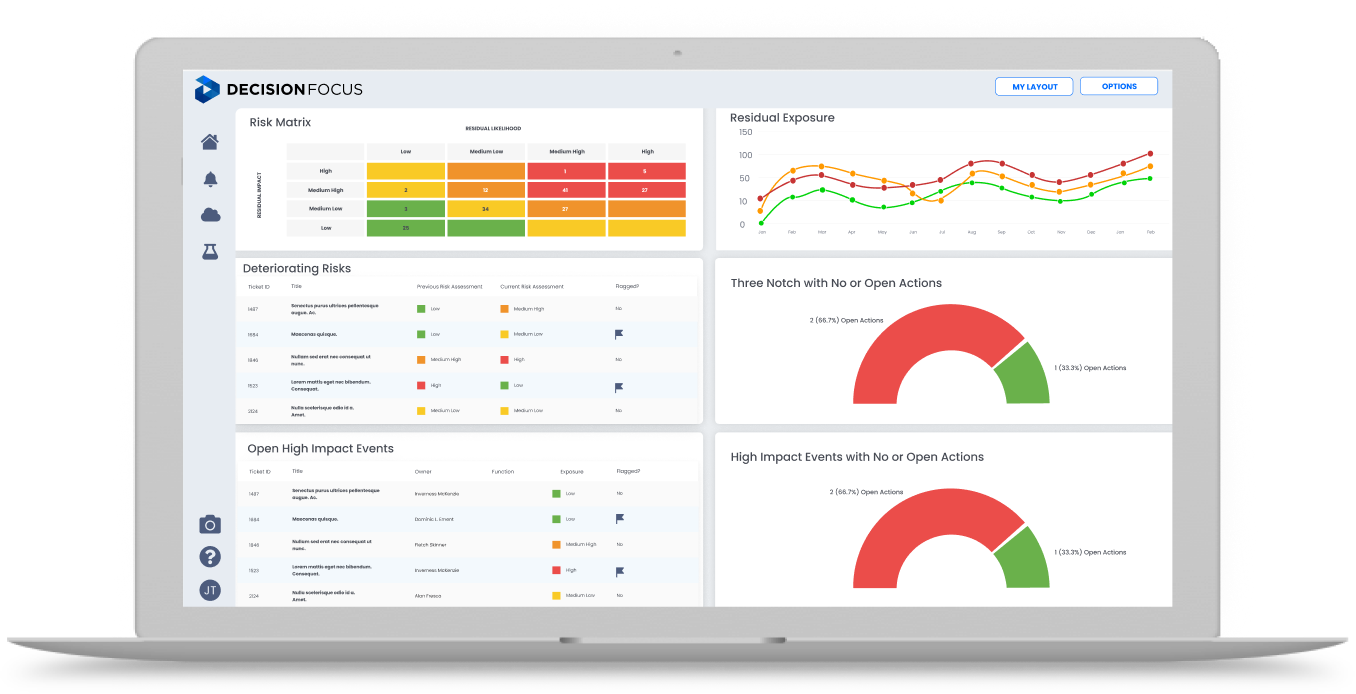

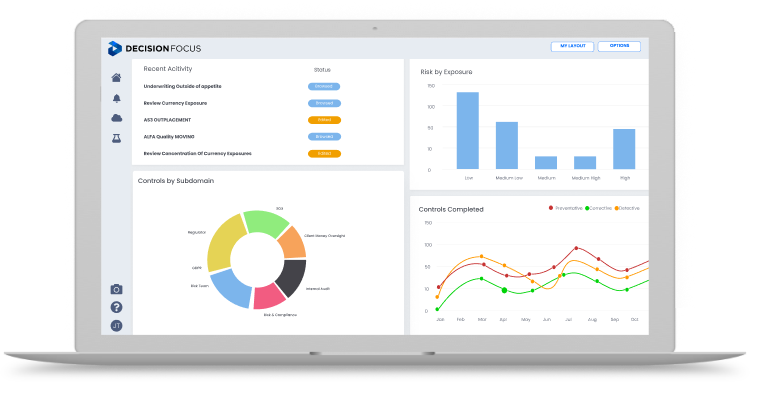

Decision Focus GRC software guides your staff through a logical, intuitive process that delivers a more objective, evidence based view of risk at all levels of the organisation. Real time dashboards and notifications direct you to where you need to focus to reduce uncertainty and move forward with confidence.

Risk

Sound, insightful risking, embedded across your organisation

Decision Focus guides your staff through a logical, intuitive process that delivers a more objective, evidence based view of risk at all levels of the organisation. Real time dashboards and notifications direct you to where you need to focus to reduce uncertainty and move forward with confidence.

Configurability. Not complexity.

Every organisation needs to manage risk, and Decision Focus is based on years of risk management experience across industries. Decision Focus is designed to be configurable to the needs and maturity level of your business – and to evolve with you over time.

Accurate risk overview

Tailoring input and access points to specific user roles makes it easier to capture relevant data on risk and remediate actions.

Acceptable risk

Mapping your proposed remediation actions against identified risks helps your organisation navigate within its acceptable risk limits.

Perfectly configurable

Working from a predefined template, the DFN team helps tailor your solution to match perfectly your organisation’s specific risk landscape.

ESG

Decision Focus empowers you with the tools you need to manage environmental, social and corporate governance.

Ready for inspection

No more scrambling to finish a report for the board or steering committee. With Decision Focus, your risk framework is ready for inspection around the clock.

Access granted

With Decision Focus, you can grant access to external parties for audits or consultation, with the presented data configured to fit their tasks.

Configurability. Not complexity.

Every organisation needs to manage risk, and Decision Focus is based on years of risk management experience across industries. Decision Focus is designed to be configurable to the needs and maturity level of your business – and to evolve with you over time.

Tailoring input and access points to specific user roles makes it easier to capture relevant data on risk and remediate actions.

Mapping your proposed remediation actions against identified risks helps your organisation navigate within its acceptable risk limits.

Working from a predefined template, the DFN team helps tailor your solution to match perfectly your organisation’s specific risk landscape.

Decision Focus empowers you with the tools you need to manage environmental, social and corporate governance

Configurability. Not complexity.

Every organisation needs to manage risk, and Decision Focus is based on years of risk management experience across industries. Decision Focus is designed to be configurable to the needs and maturity level of your business – and to evolve with you over time.

Tailoring input and access points to specific user roles makes it easier to capture relevant data on risk and remediate actions.

Mapping your proposed remediation actions against identified risks helps your organisation navigate within its acceptable risk limits.

Working from a predefined template, the DFN team helps tailor your solution to match perfectly your organisation’s specific risk landscape.

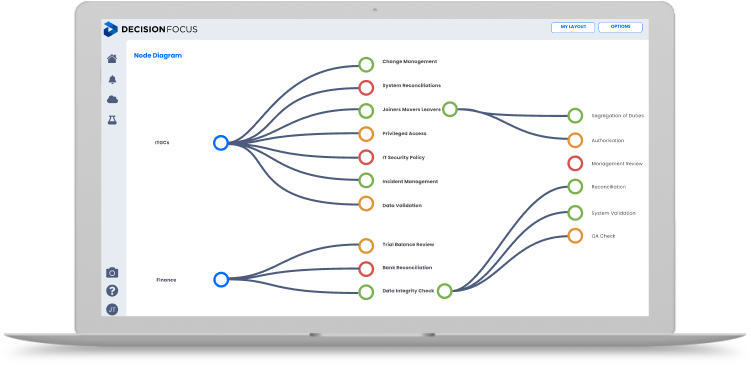

Risk and Control Identification

Risk and Control Identification

Complete linkages between risks, controls, processes, systems and testing, with all changes tracked and fully auditable

Record, document and categorise risks and controls, with hierarchies which reflect your entity, location, segment and team structure

Risk owners can propose new risks and controls, which can be vetted by the Risk team

Two-way linkage between risks and controls for a fully integrated experience for Risk, Compliance, Internal Audit and (where applicable) SOX

Risk Management & Monitoring

Risk Management & Monitoring

Define your Risk Appetite in Decision Focus with mapping to risks

Capture Key Risk Indicators (KRIs) with early warning and target thresholds

Two-way linkage between risks and controls for a fully integrated experience for Risk, Compliance, Internal Audit and (where applicable) SOX

Risk Events & Actions

Risk Events & Actions

Record all Risk Events with root cause analysis, regulatory implications and allocation of actions to responsible parties

Track remedial actions at a glance in one-click dashboards and tables where you define the parameters

Targeted notifications and reminders to keep crucial action items on track

Risk Quantification with Decision Focus

Formula Based Content

- Scheduling, control and documentation of formula runs

- Control of data refreshes in support of formula runs

- Data Quality management for datasets feeding standard formula runs

- Tracking admissible capital relative to formula output

- Capital margin appetite reporting

Model Operation

- Scheduling, control and documentation of model runs

- Transfer of scenario quantification data to capital model

- Transfer of risk quantification data from model to DF for inclusion in reporting

- Tracking admissible capital relative to model output

- Capital margin appetite reporting

Model risk management

- Model limitations logging

- Model use logging

- Model Change Control

- Validation test library maintenance

- Validation test planning including test aging analysis

- Data Quality management for datasets feeding model runs (component of validation testing)

- Manage model remediation of model deficiencies

- Validation test reporting

Scenario Based Content

- Capture of scenarios for risk crystallisation at various return periods

- Display multiple scenarios for a given risk, as a frequency/severity curve

- Include scenarios in risk reporting

- Exploit scenarios in support of capital adequacy

Risk Reporting

- Decision Focus can generate your customised Risk Committee reports and “risk on a page” documents with your font and logo

- Store, analyse and export risk and control matrices within the platform, so you have a single version of the truth

- See your risks, controls, actions and other data in a variety of one-click dashboards, tables and charts

.jpg?width=1683&height=712&name=Mac3-(1).jpg)

Ready for inspection

No more scrambling to finish a report for the board or steering committee. With Decision Focus, your risk framework is ready for inspection around the clock.

Access granted

With Decision Focus, you can grant access to external parties for audits or consultation, with the presented data configured to fit their tasks.

Risk Management Software FAQs

What is risk management?

Risk management is the process of identifying, assessing, and prioritising potential risks that may impact an organisation's objectives or operations. It involves analysing uncertainties and developing strategies to mitigate or capitalise on risks. Risk management aims to minimise potential negative consequences and maximise opportunities by implementing appropriate risk mitigation measures, monitoring risks, and adapting strategies as needed.

No red tape, no 3rd parties involved. Immediate support from the team that develop the Decision Focus platform.

What is risk management software?

Risk management software is a specialised tool designed to assist organisations in effectively managing their risk-related activities. It provides a centralised platform to identify, assess, track, and mitigate risks across various areas of the organisation. Risk management software streamlines the risk management process by automating tasks, facilitating risk assessments, generating reports, and providing real-time visibility into risk profiles and mitigation efforts.

What are the key features of risk management software?

Key features of risk management software may include:

- Risk identification: Allows organisations to identify and categorise potential risks, including operational, financial, strategic, and compliance risks.

- Risk assessment and scoring: Enables organisations to assess the likelihood, impact, and severity of risks using predefined or customisable risk assessment methodologies or scoring models.

- Risk mitigation planning: Facilitates the development and execution of risk mitigation strategies, including controls, contingency plans, and action plans.

- Risk monitoring and tracking: Provides real-time monitoring and tracking of risks, ensuring proactive risk management and timely response to emerging risks.

- Reporting and analytics: Generates comprehensive reports and analytics that provide insights into risk profiles, trends, and mitigation efforts.

- Integration capabilities: Allows integration with other systems or tools, such as incident management software or compliance management systems, to streamline risk-related processes and information sharing.

- Audit trails and documentation: Provides a secure repository for documenting risk management activities, decision-making processes, and evidence for regulatory and internal compliance purposes.

- Workflow automation: Automates manual tasks and workflows, enhancing efficiency and consistency in risk management processes.

How can risk management software benefit my organisation?

Risk management software offers several benefits to organisations, including:

- Enhanced risk visibility: Provides a consolidated view of risks across the organisation, enabling better decision-making and proactive risk management.

- Improved risk assessment and prioritisation: Enables organisations to conduct structured risk assessments, prioritise risks based on severity and impact, and allocate resources accordingly.

- Streamlined risk mitigation: Facilitates the development, implementation, and tracking of risk mitigation strategies, ensuring timely actions and reducing potential negative impacts.

- Regulatory compliance: Helps organisations meet regulatory requirements by identifying compliance risks, implementing controls, and maintaining documentation for auditing and reporting purposes.

- Cost savings: By minimising potential risks and their associated costs, risk management software can help organisations reduce financial losses and avoid operational disruptions.

- Increased efficiency: Automating manual tasks, streamlining workflows, and providing real-time data and analytics enhance operational efficiency.

- Stakeholder confidence: Effective risk management demonstrates good governance and increases stakeholders' confidence, including clients, investors, and regulatory bodies.

What industries can benefit from risk management software?

Risk management software can benefit organisations across various industries. Industries with inherently higher risk profiles and regulatory complexities can particularly benefit from utilising risk management software. Some industries that can benefit include finance and banking, healthcare and life sciences, construction, manufacturing, energy and utilities, transportation, information technology, and insurance. However, risk management is crucial for any organisation aiming to proactively identify and address risks that may impact their operations, regardless of the industry in which they operate.

Any questions?

The Decision Focus team are here to answer your questions.

.png)